Can You Use Extra Money in Retirement?

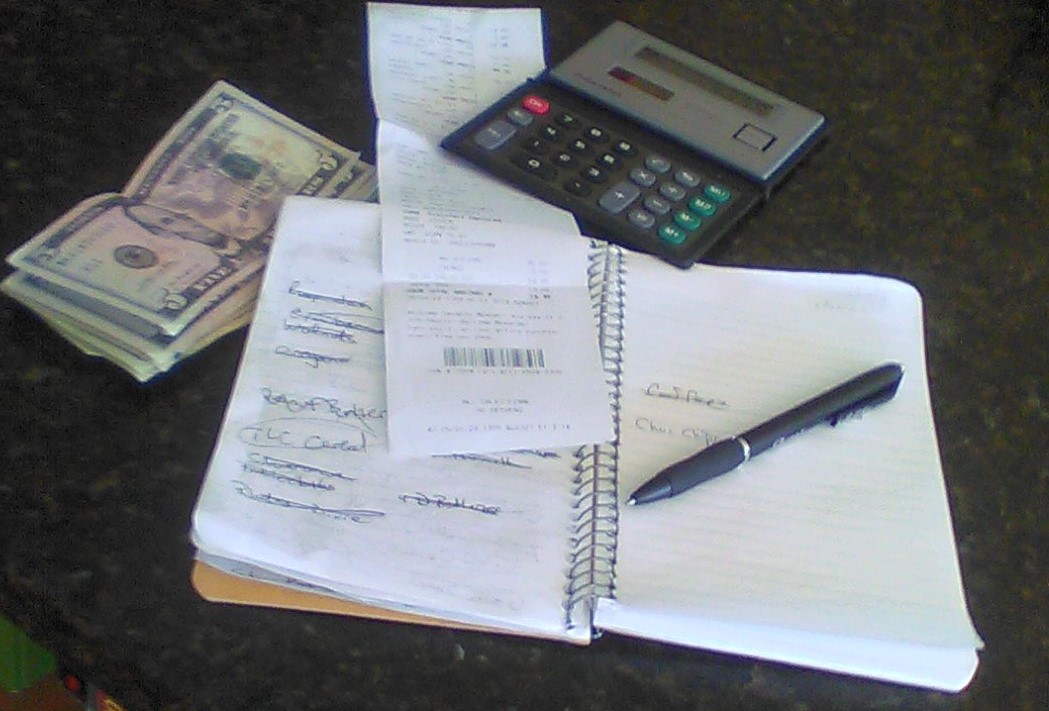

No matter what your financial circumstances are, almost everyone would agree that a little extra money in retirement would be nice. While many might need it to pay day-to-day expenses, some might use it to travel more, dine out more or buy that new car they’ve been dreaming about. There are a lot of different approaches that you can take but, even if you have no money problems at all, there is one step that everyone should be taking on a regular basis. Everyone should have a careful accounting of all of the money that’s coming again compared to all the expenses that you pay over the course of the year. It might be hard to do and might take a little time, but that exercise is an absolute must if you are going to measure your financial health.

Creating a budget and knowing all of your expenses over the course of the year is step one. Next, take a look at expenses coming up over the next one to three years. Is there a new car purchase, a major home repair looming or a wedding to be paid for? When you can anticipate those high-ticket items, it makes it much easier to plan as well as whether that extra money in retirement that might come your way is really “extra” or part of the expenses that need to be paid. I realize that may end up being a little depressing but it’s always better to know about a financial problem ahead of time rather than being surprised by it.

The good news is that there are many ways to create extra money in retirement and one of the big ones that people overlook comes from that very useful exercise described above. Take the time to look at each of your expenses and see if you can find a better deal. Obviously, you usually can’t choose your utility company but your options for things like car insurance, homeowner’s insurance, propane or oil and telephone and cable might provide significant savings. There are almost always promotions of some kind going on so the amount of savings you can realize is sometimes substantial. A period review of these budgetary expenses is something you should schedule at least once a year or whenever the next renewal period for one of these items is on the horizon.

Cutting back on spending is one way to find extra money in retirement.

Many people find extra money in retirement by downsizing into a smaller home, taking out a reverse mortgage or even selling an insurance policy. Each of these is a big move and should be considered carefully. Many people have found that they have made a tremendous difference in their lifestyle. Always make sure to look at all of the costs involved and have them itemized so you know where every dollar is going. Saying goodbye to a home you’ve been in for decades can be difficult but a friend of ours is living her dream in a new 55 and over community that she recently moved into. Her social calendar is fuller than it’s ever been, and she is going on a cruise with new friends that she has made. Don’t be afraid of something new or different. It may be the best thing you ever do.

You can also find extra money in retirement by selling your old collectibles. This is especially true if you’re downsizing. But don’t be too quick to let these things go at any price. We know of someone who has established a nice little business on eBay with what she found in her mother’s basement. That revenue was so good she started going to garage sales and flea markets to create an inventory for her web presence. You never know what people will buy but, when you find a hot item or something that sells much quicker than you ever thought possible, you may have a potential business that not only gives you extra money in retirement but provides you with many enjoyable hours.

If you have a hobby, interest or talent, don’t overlook the possibility of turning that activity into extra money in retirement. It happens all the time. Don’t underestimate your talent here and don’t be shy about taking money for something you’ve created. If you have an area of expertise, write a book or start a website. You have no idea how many retirees are doing exactly that. There are many seniors who have put together videos that teach others how to cook, sew, crochet or even make furniture. It’s really a win-win situation when you think about it. If you enjoy an activity, why not share it with someone else? And, if you can make money while doing it, that’s even better because, after all, who wouldn’t like extra money in retirement?

Of course, there’s another way to create extra income and that’s to get a part-time job. We mention it only because it’s always an option. In my opinion, a job is the last thing I want in retirement because I couldn’t wait for the day I didn’t have to work anymore. But I understand that there might be a need to return to the workforce. If this applies to your situation, all I ask is that you try to make it something you enjoy. I’d rather see people working at a golf course or in a pro shop than flipping burgers at a fast-food joint (not that there’s anything wrong with that). But that’s just me. The bottom line is that there is absolutely nothing wrong with looking for a little extra money in retirement, especially if it’s going to lead to a more active and enjoyable lifestyle. If money is an obstacle go out and do something about it. It's time to Enjoy Retired Life!

Thanks for visiting. If you like what you see here, please tell your friends.

If you think it might be fun to start your own website (it is!) please look here.

If you’d like to learn about earning a steady online income, please check out this possibility.