Fix Your Money Problems in Retirement

It’s usually high on the list of concerns for every retiree: will I have enough money in retirement to live in the manner I’ve become accustomed to? The answer can definitely be yes and, even if you haven’t saved as much as you should, you can fix your money problems in retirement if you do a little research and adopt a few disciplines that can make all the difference at the end of the month when the bills come in. But first, let me say that I am not a qualified financial advisor. Although I think I’ve done pretty well for myself and I have a number of post-graduate Finance courses on my resume, you should see a person who has more credentials than I do. For your own protection, make sure they are a fiduciary which means they don’t make an income from selling you financial products like annuities or reverse mortgages.

The most common advice people get is to do exactly what was mentioned above. Reverse mortgages can give you much needed funds and tap into the equity you’ve built over the years. And annuities can give you a guaranteed income with an initial investment. And it’s also true that you can sell a Life Insurance policy for cash. While these seem very tempting, there is a cost to them, and it is worth comparing different offers. I was curious about all of these options even though I was fortunate not to need the extra money. There is no doubt about why so many people take advantage of one or more of these options. Sometimes that upfront money or guarantee of a steady income is too good to resist. Sometimes, one of those options might fix your money problems instantly. I understand completely. But, please, do one thing before you make that decision because this one piece of advice is something you should be doing anyway.

Fix your money problems by starting with an accurate account of where your money goes.

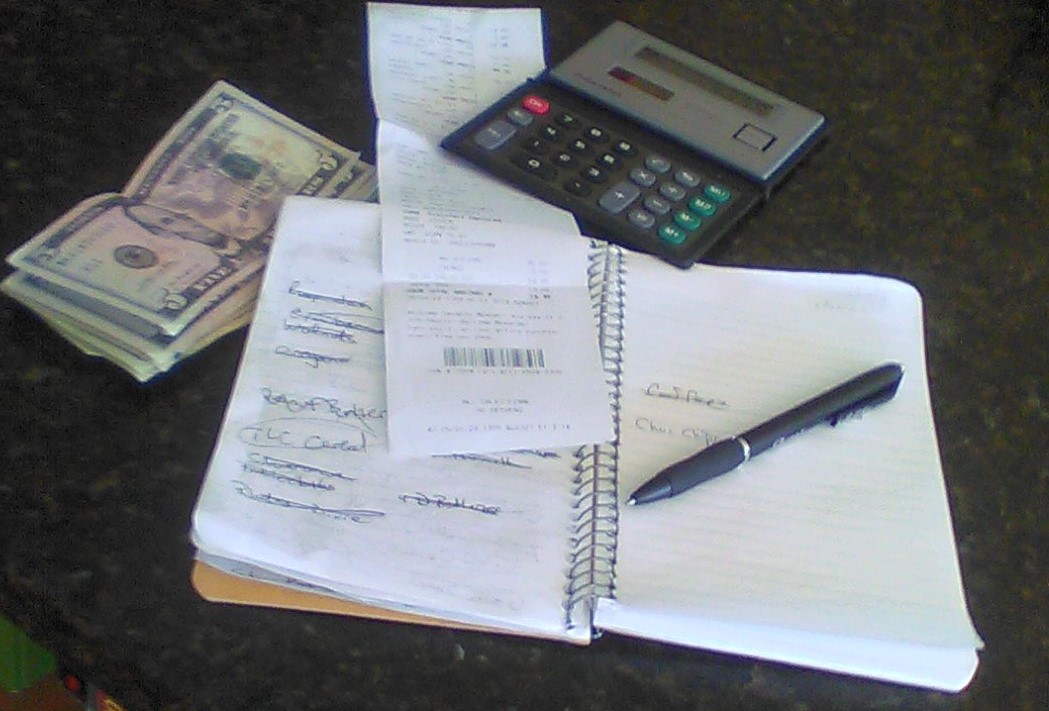

Keep a careful accounting of all your expenses. Record everything you spend money on – even a newspaper or lottery ticket. Track all your monthly bills, the invoices you may get only once or twice a year plus any donations that you make along the way. Compare that to the money that’s coming in and see how they compare. You now know the extent of your problem and have valuable information to take to a financial counselor (if you choose to do that) or create your own action plan to fix your money problems. So, what does an action plan look like?

With your list of expenses in hand, review each one carefully. Can anything be eliminated? Sometimes you can eliminate a subscription or membership that you don’t use as much as you used to. Take a look at your biggest expenditures and think about how these might be reduced. Do a little price comparison on auto insurance because, sometimes, the savings can be substantial. See if you can consolidate your credit card debt into a lower interest rate loan (but make sure you pay off those debts!) and, while you’re at it, make yourself a promise to stop making unplanned purchases.

Food is probably the area that you can control the most and it’s surprising how much money you can save. If you eat out frequently, remember that you can save money by cooking at home and, sometimes, have so much fun it becomes a hobby that you look forward to every day. Always shop with a list and look for sales from competing stores in your neighborhood. The savings can be dramatic. But resist the trap of buying something because it’s so cheap if you buy in bulk. Many people never use what they buy. A friend of ours cleaned out her mother’s house and found enough paper towels to clean a hospital for a month.

There are other bigger decisions you can make to fix your money problems. Downsizing your home might be a way to not only get the equity that you’ve built up over the years but move into a more efficient space that will save you money on utility bills and home repairs. Newer residences were built to stricter codes and the differences are dramatic. Some people end up selling their boat or second home to cut back. But, with big decisions like these, a change in lifestyle will also occur. The action plan you develop to fix your money problems should be comprehensive and as detailed as possible. If you haven’t done any research into finding lower rates for car insurance, cable, phone and homeowner’s insurance, you haven’t been as thorough as you need to be. Even after you do all of these things, there is one additional area to consider which is looking at the money coming into your bank account.

If the cost-cutting measures above still leave you with a shortfall, you still have a number of options. Of course you can always get a job. I hate to even mention the “J” word because I love retirement so much, but I know quite a few people who work at jobs related to an interest they have or a hobby they participate in. Golf courses and marinas are good places to start, and we even know someone who drives a school bus and one who substitutes as a teacher because they like to be around children. If you can do something you like and you can make some money, why not consider it?

You can also sell your junk! You can fix your money problems by turning your old collectibles into some extra cash. Websites such as eBay and Etsy have thousands of people who do this and many of them are retirees. Why can’t you be one of them? Or you can turn your hobby or interest into a profit generator. One of friends supplements his income by selling his photography and we know a very talented painter who shows up at a flea market when she has a few finished works and does very well. That becomes her vacation fund, and she enjoys doing it. You would be very surprised at how many retirees start a website based on an interest they have. One person in our community does her own cooking demonstrations and she’s created quite a lifestyle. Sometimes a problem can get you to think creatively. Don’t be afraid of where that might lead you. You’re never too old to try something new.

As you go about creating your plan to fix your money problems, don’t be surprised about what you learn in the process, especially if you consider all the options in front of you. When you turn a negative into a positive, your whole outlook on life changes. Don’t be surprised if you end up starting a business on your own. Colonel Sanders didn’t create Kentucky Fried Chicken until he was sixty-five. Who knows, you might have a hidden gold mine in your attic or a best-selling novel in your future. Give it a try! Enjoy Retired Life!

Thanks for visiting. If you like what you see here, please tell your friends.

If you think it might be fun to start your own website (it is!) please look here.

If you’d like to learn about earning a steady online income, please check out this possibility.