There's a Way to Improve Your Finances in Retirement

Everyone dreads health problems and money problems in retirement. I have always found money problems easier to deal with. As our doctor said, your DNA may have the biggest impact on your health and while you can take certain steps to have a positive impact, you can’t change your genes. It’s much easier to improve your finances in retirement than your health. Note that I said “easier” rather than “easy”. It takes discipline but you can make steady improvements if you’re willing to take a few simple steps. Let’s focus on where your money is going first. At the end of this article, we’ll make a couple of suggestions on how to increase the amount of money you have coming in.

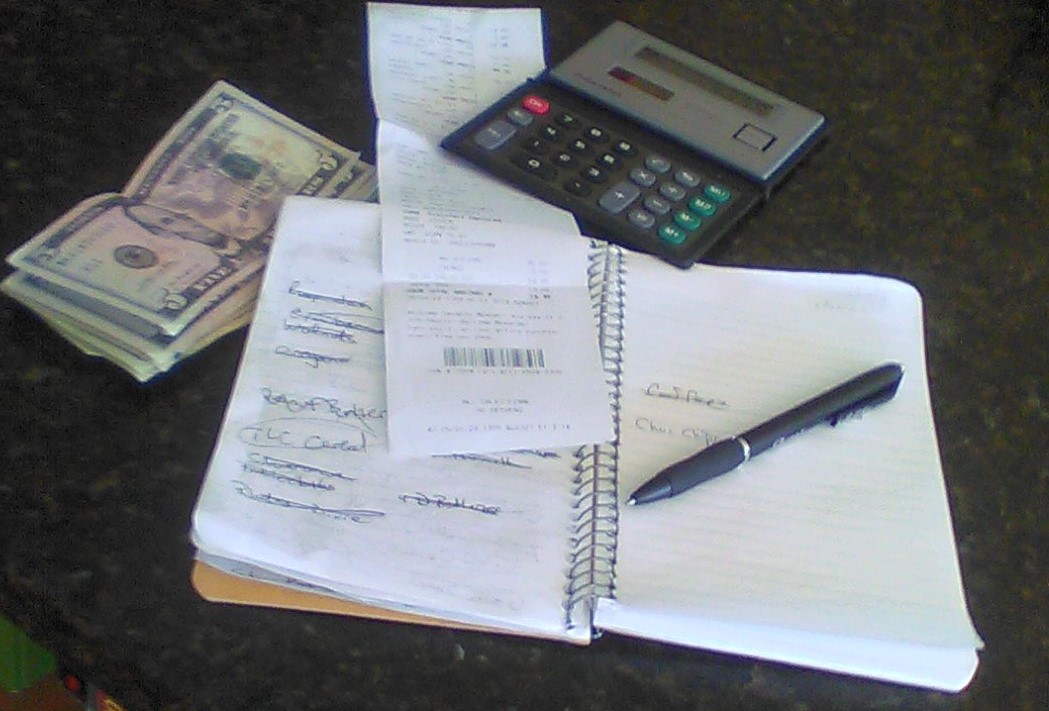

Make sure you know where every dollar is going. Having a budget is critical. For a long time, we never had a budget that worked on paper. Our expenses always exceeded our income for the first twenty years of our marriage. But we knew where our money was going, and we took steps to manage it better. When you do this, you’ll come to the same conclusion most people do: the area you have the most control over is food. Take a hard look at what you are spending at the grocery store and take note of how much food is getting thrown out. Many people buy too much and end up throwing out fruits and vegetables. Only go shopping when you have a list and never go shopping when you’re hungry. Use any frequent shopper card your store has and start cutting out coupons. Try store brands and look for lower priced items rather than the ones you normally buy. Don’t sacrifice quality but the fact is that some of the lower priced brands and items are just as good and sometimes better than name brands that you know.

Become an expert on saving money. There are many resources available online that offer excellent advice on managing your finances and much of it is free. We have found AARP to be a valuable source of information and a resource for significant savings through the discount programs that they have with so many of their partners. Take advantage of those discounts and learn valuable techniques for saving money and cashing in on rewards. Take a look at all your service and insurance providers and make it a point to check every year to see if you’re getting the best price possible. Insurance companies are notorious for raising their rates whenever they can on their existing clients but offering incredible savings for their new customers. Become a new customer for your car insurance, cell phone provider and homeowner’s policy every once in a while. It can save you a significant amount of money.

Improve your finances in retirement.

Cut back where it makes sense to cut back.

If you like to splurge by dining out or traveling, it becomes much easier to improve your retirement finances by cutting back on some of those pleasures. But it doesn't mean you have to give them up altogether. If you like to eat out, perhaps there are more reasonable restaurants. It’s always fun to give a new one a try. It’s also fun to start cooking at home. My wife and I have learned to re-create some of the great dishes we have gotten during our winter travels, and they have become favorite meals for when we’re home. We eat well and save money in the process. And don’t overlook the Happy Hour or Early Bird specials that some restaurants offer. This has saved us quite a bit of money and has fit into our lifestyle quite well. The older we get, the earlier we like to eat. Instead of my usual two glasses of wine, I might have just one (although the Happy Hour offers are hard to resist!), and instead of dessert we may have ice cream at home or skip the calories altogether. The point is that there are ways to save money and still indulge in the pleasures of life. You can improve your retirement finances by frequenting places in their off-hours or cutting back just a little where it makes sense.

If travel is one of your big expenditures, the same philosophy applies here as well. Travel in the off season can save hundreds of dollars and taking that early flight out can accomplish the same thing. Scouting for deals in advance and the money you save may mean that you don’t have to cut back at all. People have no idea how much money they can save when it comes to travel if they’re willing to be a little more flexible. And take advantage of those loyalty programs that airlines have with credit card companies. If you put things on a card and pay it right away, there are no interest charges and the points you earn can really mount up. We know that first-hand because it got us to Hawaii. There are a lot of ways to improve your finances in retirement without too much sacrifice.

Perhaps the biggest change you can make to improve your finances in retirement is to increase the amount of money that’s coming in. There are many ways to do that and some of them work quite well with retirement. We’ve all heard of downsizing in retirement. That doesn't just apply to your house. It can also apply to your possessions. Let’s face it. We all have junk that we’ve collected over the years and although it’s tempting to try and unload it all at once, taking a little time to develop a strategy can mean the difference between ten cents on the dollar and reaping a windfall with a single piece that some collector values even more than you do. The big advantage that you have is time. You can wait for the price you think you deserve rather than settling for the low-ball offer from some hustler who is going to turn around and sell your item for a handsome profit. Many retirees rent little stands in the Antique Malls that have cropped up everywhere. It’s one of the things my wife and I enjoy doing and the great thing is that the space owner doesn't have to be present all the time. Each piece is tagged with your vendor identification, and you can collect your proceeds (minus a service charge) from the owner of the store. It’s a simple process but we know a couple of people who do it and make a steady income. The modern-day approach, of course, is to sell your items online and there are many places to do that with eBay probably being the biggest. Etsy is also a great site especially for those who have a talent for creating something on their own like jewelry or some other craft.

You can also get a job if you want to improve your finances in retirement but please be sure that it’s in an area of interest. I hate to think about someone who worked all their life to retire only to get another job when there are so many other ways to make extra money. You probably know what I’m about to say next but my advice to anyone looking for an interesting hobby that holds the possibility of creating extra income is to look into a website that is focused on an interest that you have or a hobby that you’re involved in. It provides countless hours of challenging and enjoyable activities that will give you a sense of accomplishment that is hard to describe. You would be amazed at how many retirees have their own websites. It’s fun, enjoyable and can lead to extra money. What could be better? Life is too short to dwell on a temporary financial shortfall. Go out and make things happen. It’s time to Enjoy Retired Life!

Thanks for visiting. If you like what you see here, please tell your friends.

If you think it might be fun to start your own website (it is!) please look here.

If you’d like to learn about earning a steady online income, please check out this possibility.