Money Problems in Retirement

Having financial concerns at any time in your life is never easy. But once you stop working, they seem even more serious. If you’re having money problems in retirement, please don’t panic. Never rush into a solution or a major lifestyle change without first considering all the options. Let me begin by saying that I am not a financial professional. Although I’ve done a considerable amount of study and I still use the principles I learned from my graduate Finance courses, I am not certified to counsel anyone on what to do about their finances. However, I am sure that just about anyone can solve their money problems by being proactive, developing a discipline and being a little creative in considering all the possibilities.

You can consider the traditional solutions such as downsizing your residence and reducing your expenses. That’s almost never a bad thing to do if money is tight but there are things to consider first. If you love your house, it’s hard to give it up, especially if you can’t improve your lifestyle by moving to smaller living quarters. Your home can be a major source of happiness. We sold the house we had lived in for over thirty years and moved to a plot of land in the Hudson Valley that has made us extremely happy and worth all the planning and sacrifice that was necessary to make this our home. We live on a lake and never get tired of our view of the ducks and geese or the snow-capped mountains in the distance. We made the house old-age friendly with no steps and easy handicap access if we ever needed it. We do have some equity already and that can sometimes allow you to get a reverse mortgage which will leverage your investment in your home and turn it into extra cash for your present needs. These can be expensive propositions so definitely get the help of a professional to see if this might be good for you.

If you're having money problems in retirement, seek the help of financial professional.

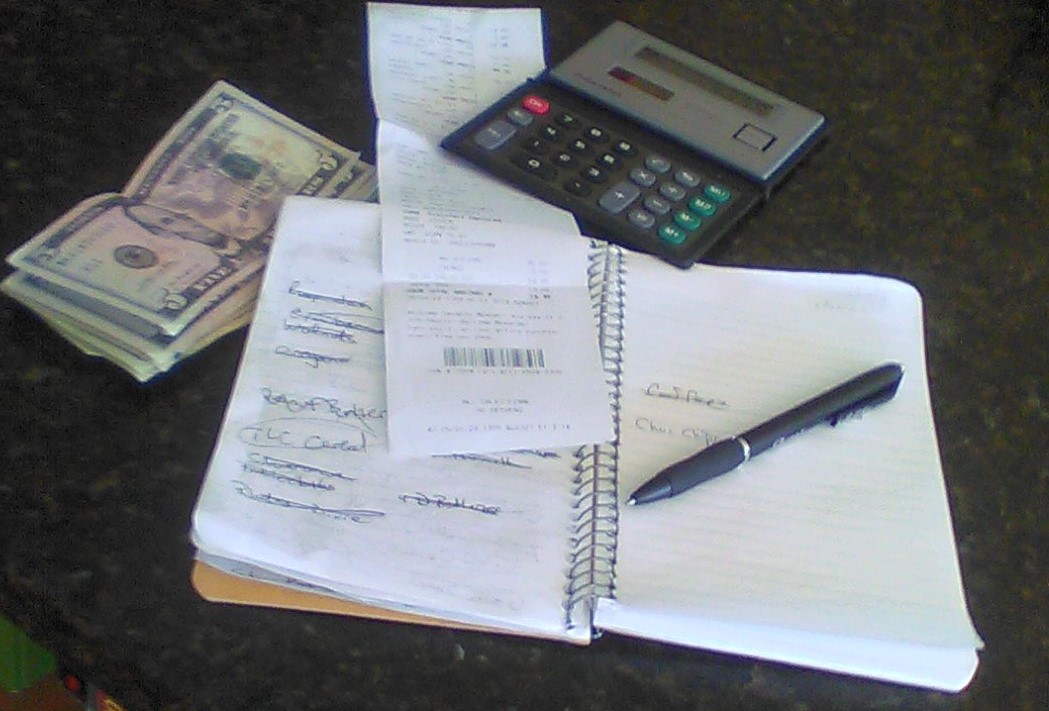

One of the first things I advise anyone to do is to prepare a detailed budget to quantify your financial shortfall. Some money problems in retirement can be solved just by cutting back a little bit on your spending. Finding extra money can be a little bit more difficult but definitely doable so, again, don’t panic. Determine if your problem is a single expense like a repair bill or dental or medical expense that probably won’t re-occur for a little while or an ongoing shortfall that will cause a money shortage every month. If it’s a one-time liability such as a repair bill that caught you unawares, don’t be afraid to negotiate with the person or organization you owe the money to and see if you can pay it off over time. This will allow you to find other sources of income like a part-time job, a side business or selling off any assets that you may have.

If you’ve run into credit card problems, you’re not alone. Money problems in retirement are quite often related to credit card debt. Keep in mind that you will have to make changes to your spending if you’re going to solve a problem like this and, if you’re not careful, your credit rating can take a severe hit. Again, don’t panic, but also seek professional counseling. Most of them will tell you that the best way to eliminate money problems in retirement that are related to credit card debt is to cut up all your credit cards so that you stop incurring debt and create a payment strategy to get you out of debt as soon as possible. Start by making the minimum payment on every card to keep the debt collectors away and look at the card with the lowest balance and increase the payment on that card as much as you can until it is gone while keeping the minimum payments on all the other cards up to date. Then take the same amount of money you used to pay off the lowest debt card and add it to the next smallest balance card until that card is paid off. Keep repeating the process until all the cards are paid off. If you do have some credit available, such as the ability to take out an equity loan on your house, use it to pay off your credit cards (because the interest rate is probably much lower than your credit card interest rates) and then make sure you pay off that loan as much as possible.

People who come out of debt are usually so relieved that they are very careful not to make the same mistakes again. If you have money problems in retirement, you should consider ways to increase your income either through a job or by selling things in your attic or basement at a yard sale. It’s sometimes very surprising how much you can make at a garage sale. If you have a lot of stuff and some of it is from a past hobby or well-kept toys or games that may have become collectible, look on the internet to see what others are selling those things for. Many retirees have started their own websites and are making a nice income through something they enjoy doing. If you have a hobby, passion or interest that you really enjoy, why not consider making some extra money by creating a website for other like-minded people. I think you’ll find it fun, challenging and very rewarding. And it’s always nice to find out you made a sale overnight! Be proactive in solving your money problems in retirement. Go out and make things happen. It’s time to Enjoy Retired Life!

Thanks for visiting. If you like what you see here, please tell your friends.

If you think it might be fun to start your own website (it is!) please look here.

If you’d like to learn about earning a steady online income, please check out this possibility.