The Road to Retirement Wealth

I won’t sugarcoat this because the road to retirement wealth should start as early in your life as possible. But, if you’ve gotten to retirement age and are still waiting for the dollars to show up in your bank account, before we’re finished, I’ll give you a couple of things to do to help alleviate some of your financial problems. It won’t be easy but there are a couple of things you can do if you are short of money at this point in your life. Let’s start, however, with a path to wealth that almost never fails. Despite the fact that I am not qualified to give financial advice, I feel confident that anyone who follows this two-step plan to the letter will come out way ahead of most people.

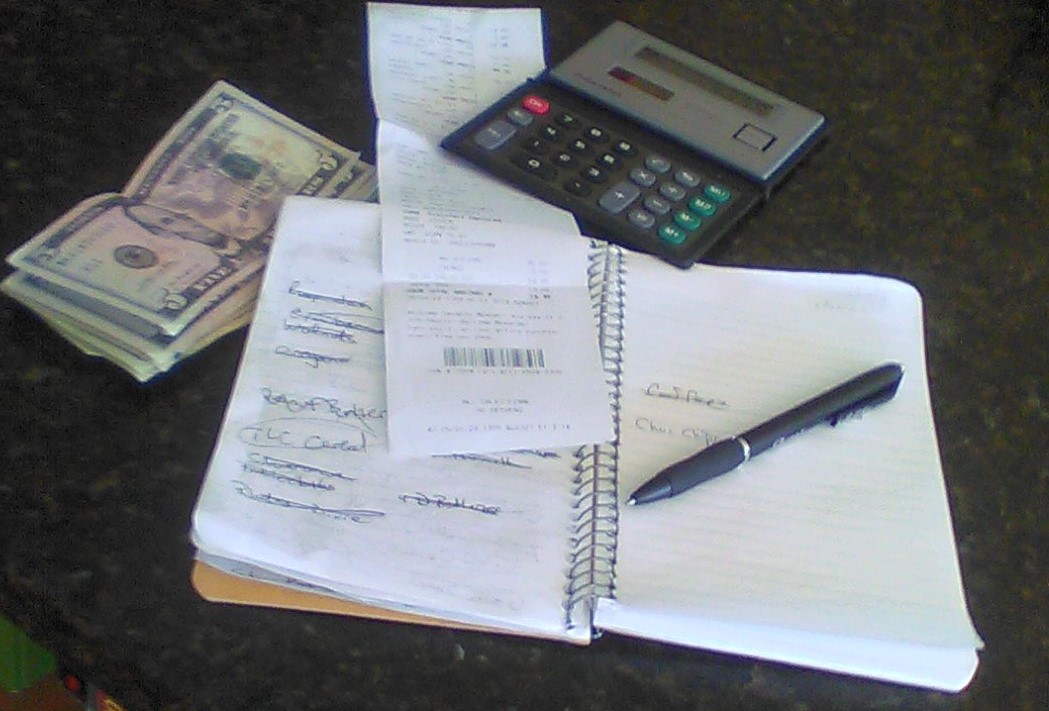

There are two basic rules to follow on the road to retirement wealth. Rule One is not spend more than you’re making. You might be saying that I should tell you something you don’t know already but that’s the reason most people end up with no money. Even sadder is the fact that they are very aware of that but can’t seem to do anything about it. The fact is that you can do something about it. It’s called a budget and it’s an exercise, not a sheet of paper. List all of your expenses and all of your income. That is your balance sheet. What most people are unwilling to do is NOT to spend the money they don’t have and to do without things like expensive clothes, vacations, cable bills and cars that are more expensive than they need. If you’re not willing to control your expenses you will probably never be wealthy. It’s as simple as that. Take a look at every expense item and see if you really need it. Call up some companies and try to negotiate a lower rate. Car insurance and cell phone plans are prime candidates. Cut up all of your credit cards and formulate a plan to pay them off. It’s easier than you might think if you take an organized approach to the process.

The second rule is to save as much as you possibly can. Putting away ten percent of your income should be your goal and the company you work for has an investment program, join it today. The biggest asset you have is TIME. The earlier you can get the magic of compounding interest to work for you, the further down the road to retirement wealth you will be. Don’t worry about being a stock market wizard, invest in a mutual fund that is designed for your age bracket and invest as much as you can as early as you can and never, never take it out no matter how much money is in there. The exception, of course, is when you are in your seventies and have to obey the rules regarding the Required Minimum Distribution for your age. Incredible as it may seem, those two rules will put you far ahead of most people as they work their way down the road to retirement wealth. But what if you didn’t follow those rules and are now facing retirement with very little savings? Don’t worry, there’s still hope!

For anyone who reaches retirement age and feels like they need more money, my advice is not to beat yourself up over your situation. You can’t change the past so getting frustrated will only be counterproductive. There are things you can do but you have to realize you lost your biggest asset: TIME. Make sure you tell your children and all the young people in your life that time is their silent partner in creating wealth. So, what do you do? You go to Rule One about not spending more than you make. It’s the golden rule of finances but most people don’t follow it or don’t think it applies to them. A good and complete budget is absolutely essential for understanding what your shortfall is. Examining every expense is critical and determining whether you can negotiate a better deal or find a better offer is one of the things you should do with each expense item. You also want to understand if your shortfall is because of one big expense or a combination of recurring expenses. A home or car repair or even medical bill would be an example of a big expense. Prescription costs, however, might be a recurring expense so think carefully about whether your situation will keep repeating itself month after month. If it is credit card related, get rid of your credit cards and embark on a debt reduction plan where you devise a plan to erase your credit card debt.

There are a few things you can look at that can significantly improve your situation. Keep in mind that these are all major steps so I would encourage consulting a financial adviser if you have one or doing your own research about each of these suggestions. The first is to downsize your living quarters if that’s possible. Many seniors don’t need the room that they did when they were raising a family. You may find this step alone can significantly change your financial picture for the better. Second, if you’ve been in your home for a while, you may have equity and could qualify for a reverse mortgage. Some of these can be expensive so make sure you do your research. On the other hand, many seniors have benefitted greatly from a reverse mortgage. The third thing you can do is to cash in any life insurance policies that you have. While life insurance is a good idea for young families, you may end up “over insured” as you enter into your senior years. Again, do you research and understand all the costs. Another hidden asset that many seniors have is buried in the clutter that you’ve accumulated over the years. Consider selling anything that might be of value but be sure to not “settle” for a price just because you need the money. It might make sense to take the time and even seek out a collector who would make a respectable offer. My wife has recently put a couple of things online just out of curiosity and has sold about ten items. She may have found a new hobby!

Controlling your spending can put you on the road to retirement wealth.

The road to retirement wealth may actually become just a way to get more income at this point in your life. Most investments build in value over time so investing in your retirement years will not have the same payback as it would have in your earlier years. I’m not saying you shouldn’t invest. I’m just saying the growth from those investments has a shorter time horizon now at this point in your life. Dividend paying stocks and some high interest CD’s or bonds might be something you can investigate but the surest way to help your financial picture is an income from a job or business and your choice will depend on what you need.

We all know how a job works. My only caution would be to do something that you will enjoy if at all possible. If you have an interest in tools, working in a hardware store would be a better choice than flipping burgers. Retirement should be enjoyed, even if you have to work. Many retirees work at a golf course to be around the game they love and make money at the same time. You can even start a business online with your own website. If you have a hobby or interest, do some exploring and you’ll be amazed at how many retirees are involved in this activity (including me) and enjoying it more than they ever thought possible. It’s not expensive to start and some people are exceeding the income from their working years. Why not think about that as a possibility? The road to retirement wealth has many different routes and, if you take a positive attitude, you’ll be amazed at how much fun the journey can be. Get going today. It’s time to Enjoy Retired Life!

Thanks for visiting. If you like what you see here, please tell your friends.

If you think it might be fun to start your own website (it is!) please look here.

If you’d like to learn about earning a steady online income, please check out this possibility.